Table of Contents

Customer education has numerous benefits for your business.

In fact, according to a TSIA Training/Adoption survey, 87% of customers who receive customer training work with the product more independently, meaning they rely less on customer service and support.

But when managing a budget for your training program, things can get complicated. Fluctuating costs, the need to scale quickly, and unpredictable expenses can make it tough to track and plan your cash flow.

Fortunately, there are software tools designed to help you budget effectively. In this article, we’ll compare the best business budgeting software solutions for your customer training needs and show you what to look for when choosing the right one for your business needs.

Create Your High-Impact Customer Education Program with Business Budgeting Software

What is Business Budgeting Software?

Business budgeting software (BBS) helps you manage your business planning and financial performance. You can use a budgeting tool to track income and expenses, forecast spending, and monitor your budget.

With the right software, you can even automate key processes like categorizing your expenses or allocating resources to help you stay on track. In short, BBS tools give you a clear overview of how your money is being spent and where you may need to adjust.

Using BBS can help you juggle the multiple costs often involved in customer training – like paying for course creation, customer training software, or your instructors – in an effective and organized way.

Why Choose Budgeting Software for Customer Training?

The right budget management software makes it possible for you to manage your customer education expenses as trackable components. You get real-time insights into your spending and financial statements that you can use to make more informed decisions about your program.

Here’s a closer look at how BBS can help you stay on top of your customer training budget:

→ Track course development costs

BBS can help you understand how much you are investing in each training module, allowing you to adjust as needed.

→ Allocate resources effectively

Using BBS can help you find areas in content, delivery tools, or instructor time that require more or less investment.

→ Monitor module performance

BBS can give you financial data to compare costs to your revenue or course completion rates. This lets you evaluate which courses offer the best return on investment (ROI).

→ Plan for the future

The real-time data-driven financial information you get from using BBS can be used to include space in future budgets for things like scaling, developing new courses, or hiring new instructors.

Using business budgeting software empowers you to manage the financial forecasting and budget aspects of your customer training program. To choose one that best serves your organization, it’s important to understand the key features to look for.

Key Features to Look for in Business Budgeting Software

Modern budgeting software goes beyond a basic spreadsheet, with numerous budgeting features and elements designed to help you manage your finances effectively. While looking for a BBS, we recommend you prioritize these key features:

Expense tracking

When looking at expense tracking, prioritize software that supports efficient budgeting by allowing you to track all of your expenses and categorize them effectively.

See if you can customize your categories for specific programs and if you can integrate the BBS with another platform so that your expenses can be imported automatically. Consider how easily you can track recurring costs, automate entries, and keep your expense tracking organized.

Resource allocation

Resource allocation means assigning different portions of your budget to different areas, like courses, modules, or marketing.

Look for software that has flexible or customizable options for granular resource allocation. See if you can use percentage-based or fixed-amount allocations and if you can alter allocations as your needs change over time.

Forecasting tools

Forecasting lets you look ahead and plan for future expenses using past spending trends. According to Gartner, 36% of CFOs find forecasting to be one of their most difficult tasks. To choose a BBS that makes this easier, we recommend considering what data a BBS tool uses to create its forecasts.

Check if the software analyzes historical spending patterns, gives projections based on upcoming projects or scaling, and lets you customize and adjust variables like new enrollments or development fees.

Reporting

In our opinion, reporting is one of the most important things to look for in business budgeting software. What you see in your reports has a huge influence on how you manage your finances, so you want a BBS that generates detailed and customizable reports.

Check how easily you can generate reports and how easy they are to share with your team or stakeholders. Bonus points go to BBS that lets you customize reports according to categories and create visual reports like charts and graphs.

Integrations

Make sure your BBS can integrate with your other platforms or apps. These could be your:

These integrations complement your BBS by providing the operational insights needed to make smarter financial decisions.

For example, LearnWorlds offers API and webhook integrations, which allows it to integrate seamlessly with budgeting software. This lets your BBS pull data from LearnWorlds (like course enrollment numbers, revenue generated, and learner engagement) and feed it directly into your budgeting platform.

Using this data, you can adjust your budgets in real time, allocate your resources effectively, and ensure your finance teams make the most strategic decisions possible for your balance sheet.

Top 7 Business Budgeting Software Options that Integrate with Your LMS

To help you find an option that works well with your customer training needs, we’ve created a list of top financial planning and analysis (FP&A) tools that integrate well with an LMS and take into account key features and pricing.

Xero – for small businesses and startups

If you’re looking for an affordable, user-friendly BBS, Xero might be a good fit. Designed to help you “spend less time in the books,” Xero is easy to use, helps you manage your budgeting process, and integrates well with other systems like your LMS.

Key Features:

Pros:

Cons:

Pricing: starts at $20/month (as of Dec. 1st, 2024).

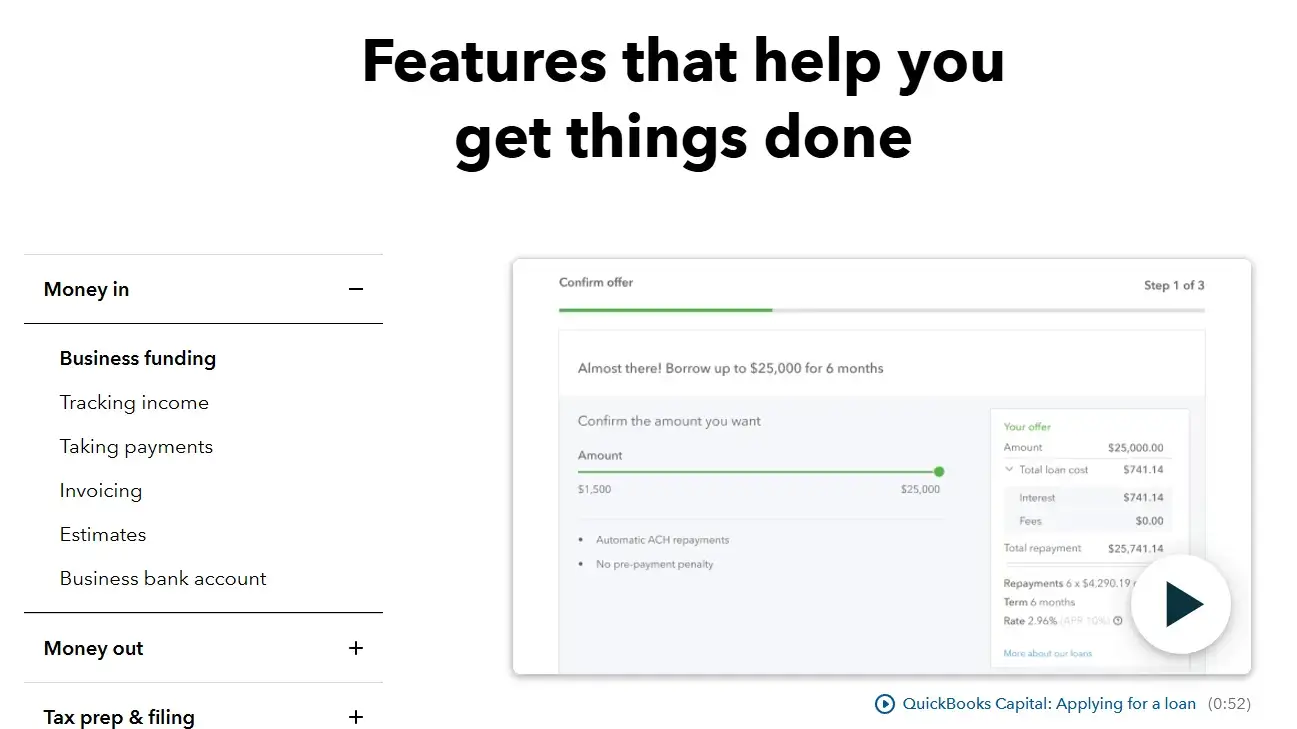

QuickBooks – for small businesses

QuickBooks is a well-known name when it comes to business finance software, and with good reason. It’s intuitive to use and integrates with other platforms, like your favorite LMS. It also offers live support options (in some price tiers) so you can get the help you need when you need it.

Key Features:

Pros:

Cons:

Pricing: starts at $35/month (as of Dec. 1st, 2024).

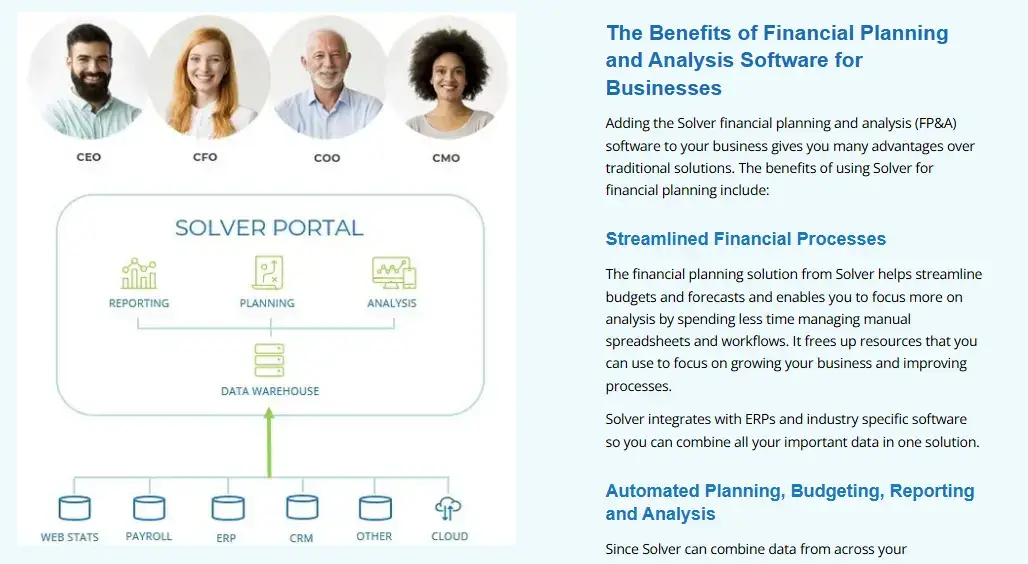

Solver – for small businesses that want to grow

If you have a small business and are looking to grow, Solver is a financial planning tool that can support you while you adapt. It has budgeting, forecasting, and reporting capabilities that help you manage your budget now and plan for your financial future.

Key Features:

Pros:

Cons:

Pricing: quote available upon request.

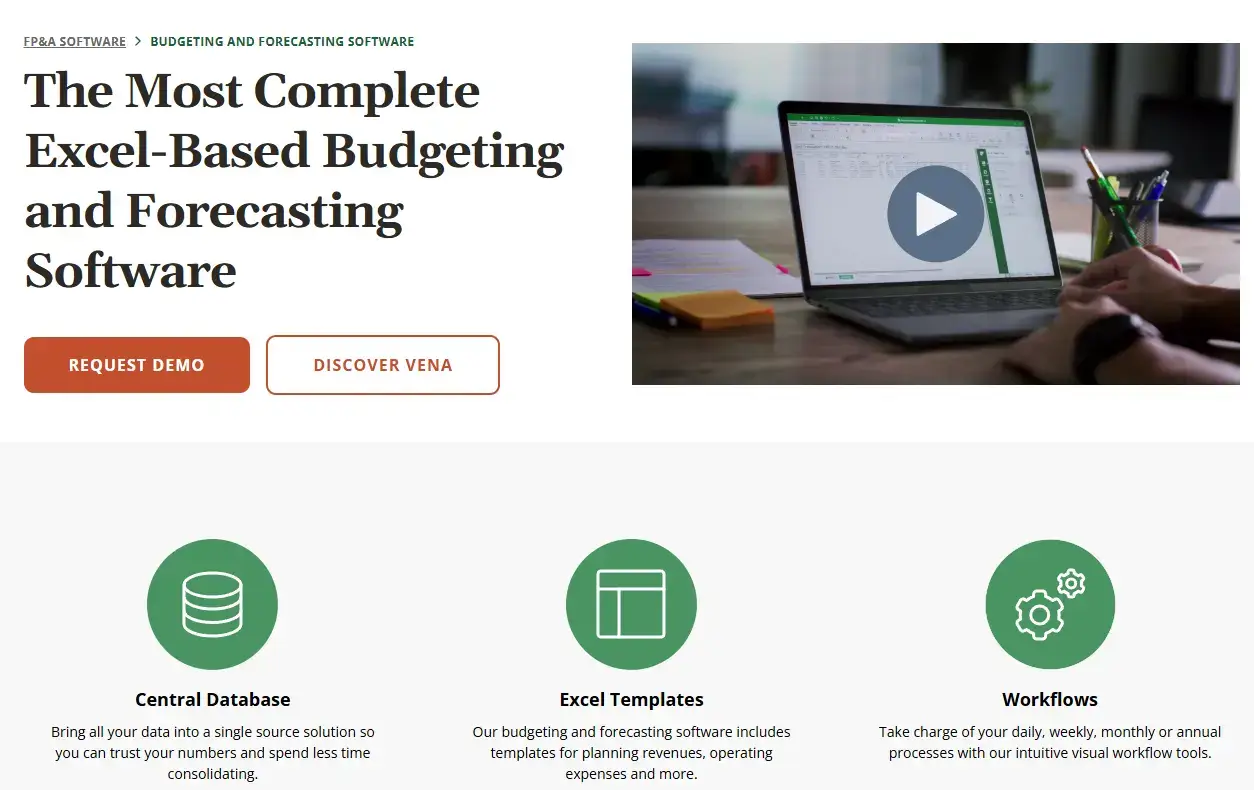

Vena – for medium-sized businesses

Vena is a great option if you have a growing business. It’s a cloud-based, FP&A “Excel-based budgeting and forecasting software.” If you are already familiar with or use Microsoft Excel to manage your finances, Vena can take that to the next level.

Key Features:

Pros:

Cons:

Pricing: choose from “Professional” and “Complete” for a custom pricing plan.

Prophix – for medium-sized businesses

If you have a medium-sized business and need advanced budgeting, reporting, and forecasting, Prophix might be a good choice. It’s very customizable, meaning you can easily tweak it to suit your specific financial planning needs.

Key Features:

Pros:

Cons:

Pricing: contact to get a quote.

Workday Adaptive Planning – for medium-, large-, and enterprise-sized businesses

Workday is an enterprise-level planning software. It’s known for its flexibility and has strong budgeting, forecasting, and reporting capabilities. Workday might be a great option if you need to grow quickly and collaborate with your teams efficiently. Workday is also an excellent choice for school districts looking to manage their budgets effectively and collaborate across departments.

Key Features:

Pros:

Cons:

Pricing: Available upon request.

Anaplan – for large enterprise-sized businesses

Anaplan is an enterprise-level financial planning solution with multi-dimensional financial modeling and advanced forecasting capabilities. If your business has complex financial planning needs, Anaplan has great long-range, capital, and revenue planning solutions.

Key Features:

Pros:

Cons:

Pricing: Available after booking a demo.

Whether you are just getting started or are at an enterprise level, there is a BBS out there to suit your needs. And seeing how a BBS can improve customer training may ease your decision-making process.

How Business Budgeting Software Improves Customer Training

Business budgeting software can provide financial clarity and actionable insights for your customer training program. Here are two, real-world examples of companies that benefit from using BBS and how that could improve their customer training initiatives.

Salesforce + Workday

Salesforce’s use of Workday’s financial automation tools demonstrates how financial efficiency can support its broader business goals, including customer training.

By using Workday’s AI and machine learning in its financial back-office operations, Salesforce automates data integration and speeds up financial processes, which frees up time and resources for strategic initiatives.

Salesforce could then reallocate that saved time and resources to customer training programs. By investing more in training, Salesforce could create more high-quality, engaging training content or increase accessibility to their learning platform Trailhead.

Deloitte Germany + Anaplan

Deloitte Germany used the financial planning solution Anaplan to replace its manual financial and capacity planning and reduced its process times by 50%. Deloitte takes advantage of Anaplan’s real-time data integration to react quickly to changing business conditions.

The flexibility of Anaplan could allow Deloitte to track and manage its budget for customer training within the scope of its broader budget, and its scalability and collaborative features could help it grow its customer training across different regions.

By streamlining financial processes, using business budgeting software can enable you to use your funds more effectively and show what you need to allocate to improve your customer training program.

💁Learn how to create a business budget to support customer education.

Tips for Choosing the Right Budgeting Software for Your Business

No two training programs are alike, and the same goes for business budgeting software. One of the most important things to consider is how your budgeting software will work with your current LMS’ key features.

Using LearnWorlds as an example LMS, here are some tips for choosing the right budgeting software.

Manage and track unpredictable training costs

Your BBS should help you identify, track, and reduce unpredictable spending. LearnWorlds’ Interactive Videos cut live session expenses by providing scalable, self-paced training. With a BBS monitoring these savings, you can better forecast and manage future training costs.

Track training data accurately

Make sure your BBS considers real training data when tracking expenses. LearnWorld’s Course Insights offers detailed metrics on learning engagement, which can help your BBS forecast refined budget decisions based on actual outcomes rather than estimates.

Allocate your resources strategically

LearnWorlds uses Tags to segment learners based on their progress, helping you identify where you can allocate funds more effectively. Your BBS should consider this customized information and use it strategically.

Scale efficiently

LearnWorlds’ Multiple Schools & Content Sync lets you manage different audiences effectively while maintaining synchronized content across platforms. Your BBS should be able to track this expansion and adjust your budget in real-time to help you manage costs as you grow.

Bonus tips:

Take Control of Your Customer Training Costs with the Right Software

Customer training is a strategic investment that directly impacts customer success and retention, and choosing the right business budgeting software is essential for managing your customer training costs effectively.

Your BBS should not only help you track expenses and allocate resources but also make the most of your LMS’ key features to help you make more informed financial decisions.

Use the tips provided and explore free trial options for the software platforms we listed to determine which is best for you.

Want to take it one step further? Start a free trial with LearnWorlds – your go-to platform for building and managing customer training programs – and explore how its features can enhance your training program and budget.

FAQs

What should I look for in budgeting software for customer training?

Look for features like expense tracking, forecasting, reporting, and LMS integration. Scalability, ease of use, and customer support are also important for future growth and to make sure you can use the tool smoothly.

Can I integrate budgeting software with my LMS for better tracking?

Absolutely. In fact, you should. LearnWorlds integrates seamlessly with budgeting software, which lets you sync your course costs and revenue and gives you real-time insights into your program’s financial status.

What is the ROI of using budgeting software for training programs?

Budgeting software increases your ROI by simplifying and managing your resource allocation and tracking training expenses. It helps you ensure your budget is optimal for delivering engaging training content that attracts and retains customers.

Ciera Lamb

Ciera is a freelance content writer and editor connecting companies with their ideal audiences through blog articles and other online content. She approaches her writing with curiosity and research and enjoys the ever-present learning that comes with being a content writer. She is also an avid scuba diver, an aspiring Dutch speaker, and lover of all things nature.