Table of Contents

Does this sound familiar?

You find yourself having just finished reporting for a new compliance mandate.

But then, regulations change once again.

You have to update every member of your team and coordinate training across all your branches, roles, and regions.

Combine this with pressure to have stringent audit trails, struggling with a high employee turnover, or the constant threat of data breaches. Suddenly, delivering effective compliance training for the banking and finance industry becomes a monumental task.

If you find yourself nodding along to all the above, I’m here with a solution: Compliance training LMS for finance.

Here’s why.

Why banks and financial institutions need an LMS

Implementing a banking sector learning management system can do the following.

Ensure compliance and risk management

Banks and financial institutions have some of the most stringent regulatory requirements in any sector.

With changing regulations covering anti-money laundering rules, KYC (know your customer), data privacy, and cybersecurity, it’s important to deliver legal and compliance training faster.

A compliance training LMS for finance supports this by pulling all your training content, automating course assignments, and ensuring you’re properly tracking course completions and in-session events. That’s perfect for preventing non-compliance risks.

An LMS for banking also nurtures a culture of risk consciousness and responsibility.

By offering continuous evaluations and immediate updates to training modules, workers stay up-to-date with the current compliance requirements and best practices. No more risk of fraud or data breaches. And that’s good for both your business and customers.

Streamline new hire onboarding and skill development

Onboarding in the banking industry is tough, as you have to bring all new hires up to speed on company policies, industry regulations, and job-specific skills on top of it. But a financial services LMS supports that mission with consistent onboarding training that gives every bank employee a high-quality introduction.

That’s a big win for improving time-to-productivity, but it’s far from where skill development ends.

Using a learning management system, financial institutions can provide personalized learning experiences based on each employee’s role, department, or career goals. Interactive learning modules, professional certifications, and advanced training content help your people with skill development and job performance improvements as early as the onboarding process.

Help you keep up with industry changes

If you’re in the financial sector, you have to respond to changing industry regulations and demands quickly by updating and implementing new training programs the very second that new laws and requirements are issued.

Plus, an LMS for financial services comes in handy when you expand your team. You’ll need more advanced training programs or options for training employees worldwide, not just on-site.

Advanced analytics and reporting capabilities provide a means to assess training needs and measure training progress. This gives financial services companies and organizations in the banking industry the ability to keep improving their training process so that all employees will have the necessary skills for their role.

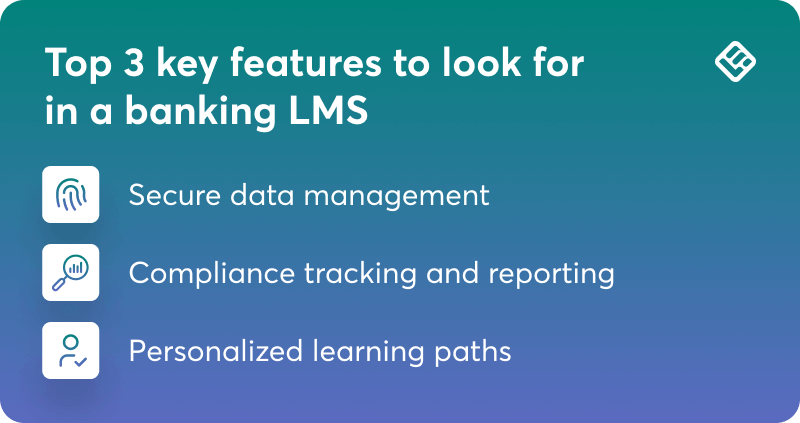

Key features to look for in a banking LMS

Let me take you through what really goes into an LMS and bank training software.

Secure data management

Remember this: Data security above all. The banking industry handles sensitive data and confidential financial information.

An LMS must protect sensitive information with features like data encryption, multi-factor authentication, and role-based access to prevent unauthorized access and potential cyberattacks.

For banking and finance organizations, a Learning Management System (LMS) must go beyond basic training functionality to meet regulatory, security, and scalability needs. Given the sensitivity of financial data, the LMS must support encryption, single sign-on (SSO), user access controls, and compliance with banking-grade data protection standards.

Sergiy Fitsak, Managing Director, Fintech Expert at Softjourn

Another must-have? Automatic backups and disaster recovery. These keep important training records or employee progress reliably stored, even when a system fails or in the event of a cyberattack.

Compliance tracking and reporting

Keeping up with compliance needs is easier with a bank training software that automates your compliance tracking. This is a must for getting immediate insights into your employees’ training and progress. It also allows managers to track course attendance, find learning gaps, and keep the organization audit-ready at all times.

I’ve seen how regulatory complexity and rapid change in the finance world mean that any LMS we use needs to be adaptable and compliance-ready. I think one of the most crucial LMS features is compliance tracking, because I’ve worked in environments—like at HSBC and Hargreaves Lansdown—where training records aren’t just nice to have, they’re legally necessary.

Sam Hodgson, Finance Editor at Clifton Private Finance

As for the nice-to-haves, automated alerts and reminders for certification renewals or mandatory training are functionalities to keep an eye on with any financial services training platform.

Personalized learning paths

Everyone should have a slightly different learning path. A financial services LMS will let you create personalized learning paths to deliver training that is role-based, department-based, or driven by skill gaps.

A teller, a portfolio analyst, and a cyber-risk officer do not need the same depth in derivative pricing or know-your-customer checks. An intelligent LMS assigns courses automatically based on job codes so employees see only relevant material. Completion rates rise, boredom fades, and the branch operates with sharper skills across the board. Content creation tools keep the catalog fresh. New sanctions or product launches do not wait for quarterly updates, so compliance teams must be able to drop a quick video or interactive case study into the system overnight. Staff log in the next morning and get the update before a single transaction is processed. That agility prevents knowledge gaps and shows regulators that the bank responds to a change in real-time.

Sami Andreani, Chief Financial Officer at Oppizi

Don’t forget about what employees want. For instance, easily digestible, modular training (eg microlearning, video tutorials, or interactive courses) can give them a way to learn at their own speed and go back to revise key messages whenever necessary.

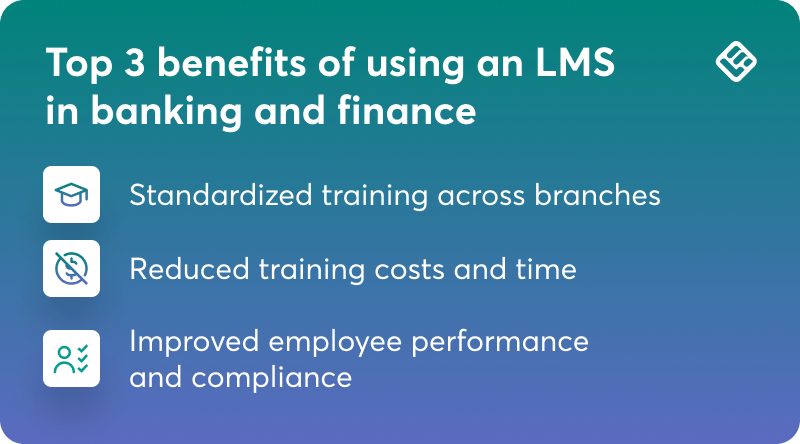

Top benefits of using an LMS in banking and finance

For professional development in the financial industry, an LMS can provide a stellar training experience and a lot more, as you’ll see next.

Standardized training across branches

Bank training software gives all employees access to the same quality of training content, no matter where they’re based.

For financial services training, such standardization keeps all processes compliant and reinforces a stronger company culture. From onboarding to ongoing compliance requirements, an LMS for financial services organizations ensures that important information reaches everyone at the same time, without the risks.

Reduced financial services training costs and time

Conventional training, though, often involves travel, printed materials, and trainers who teach in person (which can be expensive and slower). Digital, self-paced learning through an LMS can lower such costs.

And you’ll also be looking at some solid time savings. Automatic progress tracking, assessment, and reporting minimizes administrative overhead, leaving resources for other strategic initiatives.

Improved employee performance and compliance

A good LMS means employees will finally master (not just dabble with) the knowledge and skills they need to succeed in their jobs. Plus, it’ll all be engaging with fun modules, personalized learning paths, and instant feedback to keep staff involved and motivated.

Automated compliance monitoring comes next to keep everyone in line with all regulatory guidelines to avoid potential fines or a loss of reputation.

Choosing the right LMS for the BFSI industry

We’re getting closer to picking the right LMS for BFSI industry. Below are some of the top options you will find currently available in the market.

To help you choose the best solution for you, here’s the criteria you need to report on.

Assessing specific business needs

Choosing the best LMS for banking and finance starts with knowing what your company needs. Think about whether you’re more focused on:

Most banks and financial services organizations will need strong audit trails and compliance guarantees. Dealing with a global team? You’ll also want to prioritize mobile or self-paced learning capabilities as well as role-specific training options.

Solutions like LearnWorlds excel at being flexible enough to let you customize learning to meet the changing requirements of financial institutions. It offers custom user roles, a fully branded mobile app, in-depth analytics, and strong data security options. Try it out today.

Ensuring scalability and integration options

Ready to grow? So should a flexible LMS. Search for tools that allow you to easily manage new users and integrate new technologies (eg AI-assisted analytics or mobile learning).

LearnWorlds doesn’t place any limit on the number of learners. Combine this with its out-of-the-box integrations with plenty of HR, CRM, and compliance management systems, and you have a perfect solution for future-proof, scalable training.

Prioritizing user-friendly interfaces

Now think about what your employees and instructors want every day: It’s probably an easy-to-use interface that can support engagement and increase course completion rates. That includes simple dashboards, clear navigation, and even responsive customer support.

After all, good user experiences not only make training more enjoyable but also support continuous skill development.

💡Read more: Top 7 best compliance training LMS

Final thoughts

But when it comes to the best LMS for banking and finance, don’t just look at it like a compliance checkbox. The ultimate goal is to meet your best interests moving forward, whether these are simplifying regulatory training, speeding up onboarding, or helping your workforce succeed.

Whether you’re looking to completely revamp your training efforts or have a better way for ensuring continuous compliance training, LearnWorlds has the flexibility, security, and scalability you need.

Grab a free trial to see its full features in action on your own team.

Alexandra Cote

Alexandra Cote is a SaaS growth marketer and online instructor who's worked with dozens of brands in the MarTech, HR tech, and productivity space. She's also a strong supporter of staying happy at work and choosing a healthy career path.

FAQ

Everything you have ever wondered, but were too afraid to ask...