Table of Contents

Want to give your learners an easy and stress-free way to pay for your online courses?

Getting someone to make the very first purchase of one of your online courses is the most important – yet most difficult task. However, once a student takes this very critical first step, then all subsequent purchases usually come much more naturally.

Here at LearnWorlds, we always strive for the best, and to honor the statement, we are offering you the ability to provide learners with frictionless and secure payment options.

By utilizing multiple payment types, such as credit and debit cards, mobile checkouts, bank transfers, PayPal, and Stripe, for example – we are helping you make the process of purchasing your courses less intimidating for your learners. This helps build more trust, which can have positive results on the success of your courses, and much more!

Read on to learn about the payment options available by LearnWorlds, and how to make the payment experience as personalized, flexible, and seamless as possible!

Table of contents

Let Your Customers Choose How They’d Like to Pay

As a way of giving greater freedom to financial transactions, LearnWorlds supports the most popular payment gateways – including the ones preferred by your learners. It also comes with multiple payment options that cater to the most demanding needs.

Our platform currently offers the following payment options:

Now, let’s check each one and explain how you can use them to their full potential.

One-time payments

These are the one-time payments (single course sales or lump sum payments), where customers pay a fee before they can get their student account and join your course or online classes. The fee is set upon the price you decide to give to your course, and it’s sold only once.

💡 Need help deciding how much to price your courses? Check out our guide here.

Monthly & Yearly Subscriptions

Monthly and yearly subscriptions – memberships or recurring payments, are ideal when you want to sell courses that are continuously updated with new content. They can be used when you want to sell them at a higher-than-usual one-off or at a lower price via recurring payments. These yearly or monthly payment plans – subscriptions, can also help you earn revenue for longer, as opposed to one-time payments.

💡 You can learn more about it and how you can create subscription plans here.

⚠️Subscriptions require an active subscription to a Pro Trainer or higher plan and using Stripe as the payment gateway.

Course Bundles

Course bundles offer you the ability to create a bundle of set courses and sell it at a special – often discounted price. Doing so provides you greater flexibility in promoting your courses, but also makes it easier for your learners to buy several courses at once.

From a marketing perspective, using course bundles is ideal for both you and your learners as they get a great value-for-money deal: with a special discounted price on your courses, they get access to an even bigger source of learning and additional knowledge.

💡 You can find out more about course bundles and how to create them here.

Installments

Installments – as part of the payment plans, are designed to make your courses – especially the more expensive ones, even more affordable to your customers.

Installments or installment payments is a payment solution that aims to make the financial transaction easier, providing the option to break down the total payment into manageable chunks of money.

This helps customers feel safer when they are entering their credit card details and trusting you with their money. They want to choose a payment method that is right for them and easier on their wallet.

The e-commerce industry is constantly evolving, always coming up with more and more convenient ways to conclude an online transaction. We can say with confidence that the installments implementation in LearnWorlds is by far the most robust and flexible in the industry, ready to serve any pricing option and business model.

We are determined to stay at the edge, making the distance between your courses and your next customers as small as possible.

Installments break a larger payment into smaller ones at regular intervals. It’s a great way to offer high-ticket courses to an audience that wouldn’t otherwise be able to afford them or need additional financial aid to join your online programs. Payment plans are not the same as memberships or subscriptions, but they can be a great alternative.

What are the benefits of installments?

Installments provide a valuable break for students who would otherwise struggle to pay the whole amount at once. In fact, installments seem to be a preferable option for the majority of consumers, as recent research from installments provider Splitit showed the following:

6 Expert Tips When Using Payment Plans

Here are some expert tips for using payment plans and increasing your courses’ revenue:

Tip #1: Ask for a higher initial installment

Ask for a first installment that’s 2 or 3 times higher than the next installments. This way, you’re asking someone to commit to your course.

Tip #2: Keep the number of payments low & under a year

The longer the payment plans, the more chances for someone to cancel or default on the payment. Keep the number of payments low and don’t let them spread for more than one year. Monthly installments can help avoid late payments and make it easier for learners to remember the due date.

Tip #3: The dollar amount matters

You will make significantly more sales if you keep each payment in the double digits. Any price that crosses a double-digit border elicits a strong negative psychological response. For example, going from $99 to $100+ makes a huge difference from a mental standpoint. The number of payments, however, has quite the opposite effect, as we’ll see later.

Tip #4: Don’t set your price too low

Find the right balance, and do not set installments (especially the first one) too low. The higher the value of your course, the higher the engagement and worth of your customers!

Tip #5: Coordinate drip content & expiration with the payment plan

It’s a good idea to offer a payment plan along a drip-feed course, so if someone stops paying, they lose access.

Similar attention goes to course expiration. If the course access expires for your users, keep them a little longer than the last payment, so you give them a chance to study your course.

Tip #6: Charge a little more than the one-off payment

It’s reasonable enough that the total charges from the payment plan be slightly larger than the one-off payment. Besides, you are not asking for the entire amount upfront. You should charge at least 5%-10% higher than the original price.

This is also an incentive for the customer to buy your one-off priced course!

Examples of payment plans

Now, if you have never set up payment plans before, here are some examples from which you can draw ideas for your own plans:

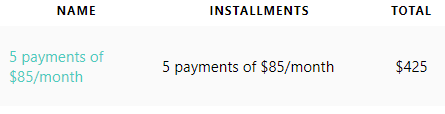

Scenario n.1 – Course price $400 to $425 with a Payment Plan

Often with a payment plan, you charge a little more since you aren’t getting all the money upfront. For example, in the initial price above, you can raise each payment to $85 per month.

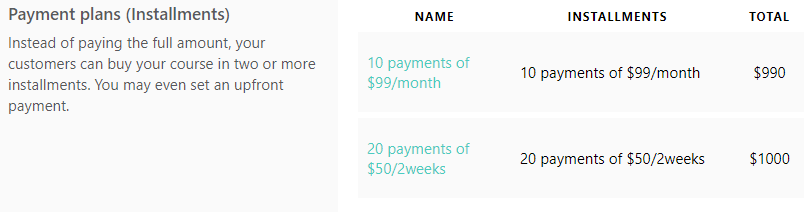

Scenario n.2 – Course price $900

What would draw the attention of more students, a 4-payments of $225 plan or a 10-payments of $99 plan? That’s right! The second plan. It has been proved that customers are more likely to opt for ten payments of $99 even though it results in paying 100 extra dollars over the other plan.

And vice versa: If you increase the payment from $99 to $125, the overall percentage of payment plan customers will go down even though the total overall cost will be lower! Strange but true.

So, the payment plans you can create for a $900 course could be these:

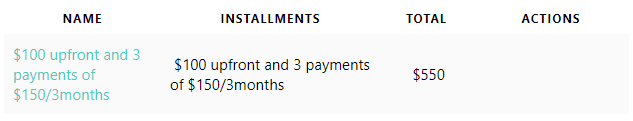

Scenario n.3 – Course price $550

Another way to facilitate student payments is to set longer intervals between the required installments. For example, instead of one-month intervals, you can ask students to pay every three or six months.

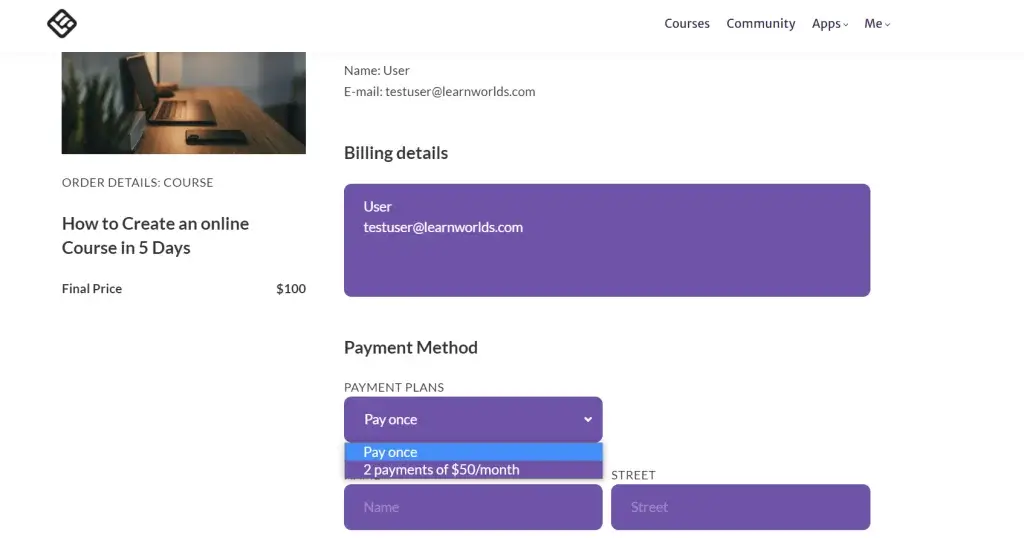

Payment Plans on LearnWorlds

LearnWorlds is the most robust and flexible course platform to create, host, and sell online courses. As such, it offers an easy way to add payment plan options to your online courses.

All you need is to connect Stripe as the payment gateway and set up your price.

LearnWorlds also comes with user-friendly payment forms. Your payments will look professional and trustworthy.

💡 You can read more about payment plans and installments for LearnWorlds here.

⚠️Payment plans require an active subscription to a Pro Trainer or higher plan and using Stripe as the payment gateway.

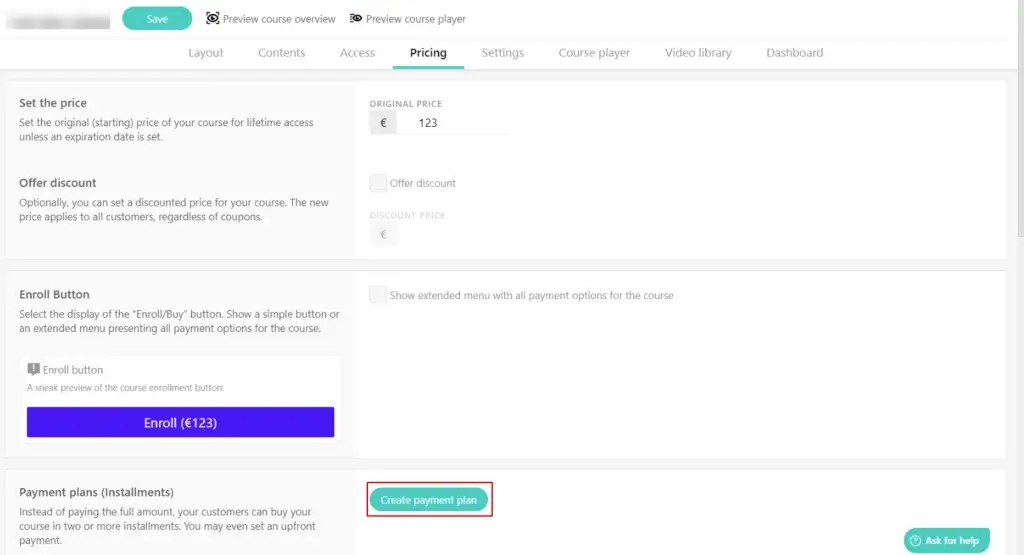

How to set up installments in LearnWorlds

Setting up installments in your LearnWorlds school is a breeze. All you have to do is:

- pick a course or bundle;

- set up how many installments you want to make available (e.g., 6);

- and the intervals you want to set between each payment (e.g., 1, 3, 6 months).

You can choose between a simple payment plan (a number of equal payments) and an advanced payment plan (with a bigger upfront payment and a number of smaller installments). You can even set up how many days after the initial payment the installments will start to be collected.

The opportunities are endless, and you can set up just the right plan that matches your audience and business model.

💡 Need more help with payments? Make sure to check out this article on our Help Center.

Mobile Payments

Mobile payments are growing rapidly in the US, with major digital wallet players, like Apple Pay and Google Pay/Google Wallet, counting almost 70 million users in 2021. This number is expected to grow further in the coming years, according to a study by eMarketer.

But if you can afford to overlook the numbers, then think of the frustration that a complex checkout process can cause your customers. Especially for those already using digital wallets, having to memorize credit card numbers can discourage online purchases.

Credit Card-Less Payments

As mobile payments break new records and ‘buy now, pay later’ options are on the rise in eCommerce and online education, we are helping your customers purchase your course without a credit card. That’s why we’ve added Apple Pay, Google Pay/Google Wallet, Klarna, and Afterpay to the payment options you can offer your customers.

Besides, it’s no secret that checkout abandonment can break your sales, no matter how awesome your course is. The now old-school credit card is still effective and loved, though flexible and fast payments are not indifferent to anyone these days.

Imagine how easy you can make it for your customers to check out only by using Face ID that comes with Apple Pay Wallet (or to pay in installments) using their Klarna account. Payment flexibility is definitely a key factor in online payments, and LearnWorlds is here to help you never miss a sale again because of limited payment options.

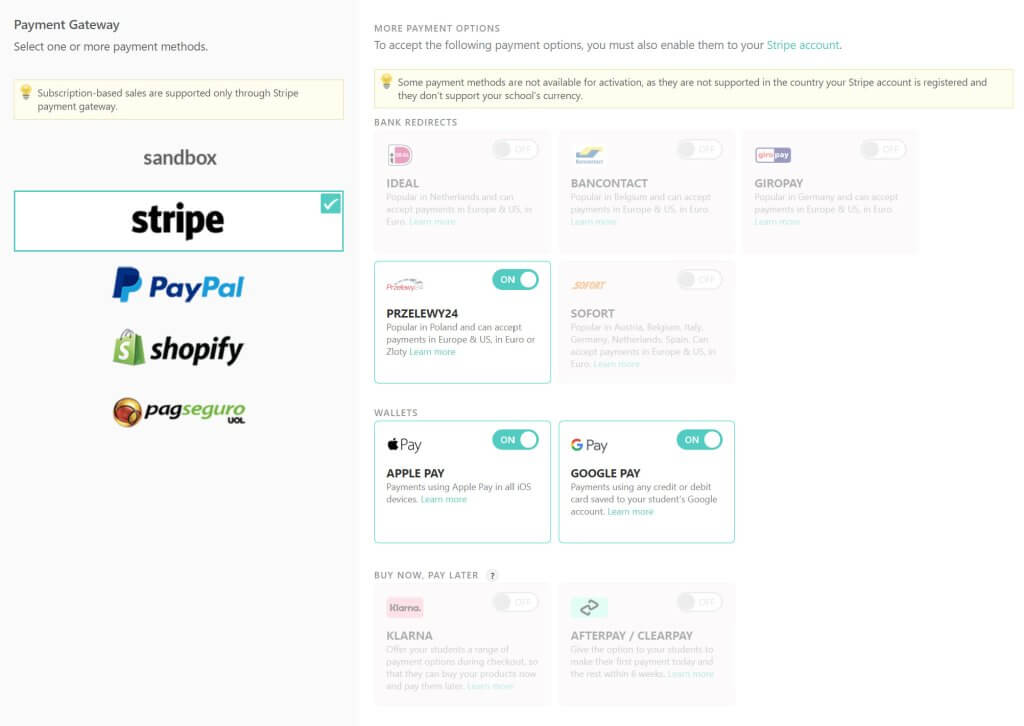

Apple Pay & Google Pay/Google Wallet

On top of the aforementioned flexible payment options, we also offer Apple Pay and Google Pay/Google Wallet payments. With these, you get to offer a checkout experience – via desktop and mobile (mobile apps), that enables you to sell more courses in line with your customer’s preferences.

The result? Your sales funnel is now mobile optimized down to the checkout stage, making enrolments easier. Apple Pay and Google Pay can be used on both mobile devices and desktops, allowing for more widespread adoption.

Buy Now, Pay Later

Let’s not forget Klarna and Afterpay – or Clearpay (as it is known in the EU), which can work as your checkout optimization partner in digital wallets. These are the most popular “Buy Now, Pay Later” options and are in the game to help you get more enrollments in your courses!

What is ‘Buy Now, Pay Later’?

Adding “Buy Now, Pay Later” (BNPL) options to checkout enables your customers to enroll in your courses instantly, though they can choose to pay the fee at a later date or through installments.

If this sounds like a drawback to your cash flow, you’ll be excited to hear that the enrollment fee will be paid to you upfront at the time of the purchase. This leaves Klarna or Afterpay to handle pending payments while keeping your customers satisfied and your bank account in perfect balance!

What Are the Benefits of Offering Klarna and Afterpay in Your Checkout?

Boost your sales

Some of your customers may find in your course their next learning goal. But no matter how strong their intention to buy is, their finances are always stronger. These customers will love you for allowing them to enroll in your course instantly and pay at a later date or through installments.

Increase average order value, cross-sells, and upsells

Flexible payment options encourage larger purchases. As long as a customer feels that their finances are under control, buying an extra course or grabbing an offer that pops up during checkout becomes more appealing.

Make your business more competitive

Chances are that your competitors are already offering their customers the BNPL option. If they aren’t doing it yet, they will definitely do so in the near future. So if you want to help your business grow, don’t stay behind the competition.

How to Activate These Payment Options on LearnWorlds

Apple Pay, Google Pay/Google Wallet, Klarna, and Afterpay are compatible with Stripe, so you can activate them through the Stripe configuration in your account’s Financial settings. When you turn these options on, they will automatically appear on your checkout pages.

⚠️ Keep in mind that Klarna and Afterpay are available only in specific countries, and users outside of these countries will not be able to choose them as payment options.

💡 For more information on activating the new payment options, please check the following articles:

💁 Apple, Apple Pay, Touch ID, and Face ID are trademarks of Apple, Inc., registered in the U.S. and other countries and regions. Google and Google Pay/Google Wallet are trademarks of Google LLC.

If you are looking for ways to increase your online course sales, accepting payments via Apple Pay, Google Pay, Klarna, and Afterpay is a great place to start with. At LearnWorlds, we prioritize finding the best ways to reduce barriers, so you can maximize enrollments without losing any potential revenue from a lack of payment flexibility.

Ready to Sell More Courses And Boost Your Sales?

By utilizing LearnWorlds’ cutting-edge payment options to sell online courses, you can increase the sales of your high-ticket courses, attract more customers and increase your prices.

Allowing learners to make payments and purchase your course quickly and with minimal effort can also help boost conversions and grow your business significantly.

Our payment solutions are designed not only for speed and ease of the financial processes but also to ensure security.

All of these options can help you create a win-win scenario for you and your learners. So, what are you waiting for? Start your free 30-day trial with LearnWorlds today!

Frequently Asked Questions – FAQs

What is a payment plan?

Payment plans describe a way of payment where your learners get to pay for your courses through installments instead of paying the entire amount upfront. They help to break a larger payment into smaller ones at regular intervals.

💁 Check our relevant support article for more information.

Should I offer a payment plan?

Payment plans are a great way to make a high-ticket purchase affordable. If you have a digital product priced above $300, consider offering it with a payment plan.

Can I offer payment plans through LearnWorlds?

Yes, LearnWorlds allows you to offer payment plans and installments.

You will need to have a paid subscription to the Pro Trainer plan or higher and connect Stripe as the payment gateway to offer payment plans or installments as an option.

How do payment plans work?

Payment plans break a bigger payment into smaller, more manageable chunks. For example, if you have a product priced at $500, you can offer it for an initial payment of $200 and 3 monthly payments of $100.

Are payment plans different from memberships?

Yes. Memberships or subscriptions are intended for a community, coaching, or course which offers a recurring benefit and can potentially be indefinite or for as long as your customer sees value in it.

On the other hand, payment plans are intended for higher priced products as a convenience to a buyer who would not be able to afford them otherwise.

Does Kajabi allow payment plans?

Kajabi offers payment plans through subscriptions (weekly, monthly, and yearly). LearnWorlds is a better Kajabi competitor offering a greater wealth of options when setting up your payment plans.

Does Teachable allow payment plans?

Teachable offers payment plans that allow learners to pay a set amount of monthly fees – up to a maximum of 36 months, in order to access courses. LearnWorlds gives you more flexibility in terms of payment and the selection of the due dates and intervals between payments.

Does Thinkific offer payment plans?

Thinkific offers the option to set up payment plans and create bundles for your products. On their payment plan, the price is split automatically into monthly payments. LearnWorlds comes with both payment plans and bundles but offers additional payment gateway options.

Does Podia offer payment plans?

Yes, Podia offers payment plans and communities through Stripe. It also comes with alternative payment methods such as Google Pay, Apple Pay, and iDEAL just like LearnWorlds. However, Podia’s payment plans aren’t as flexible as LearnWorlds’.

Kyriaki is a Content Creator for the LearnWorlds team writing about marketing and e-learning, helping course creators on their journey to create, market, and sell their online courses. Equipped with a degree in Career Guidance, she has a strong background in education management and career success. In her free time, she gets crafty and musical.