Table of Contents

Payment plans, or installments, break a larger payment into smaller ones at regular intervals. It’s a great way to offer high-ticket courses to an audience that wouldn’t otherwise be able to afford them.

Payment plans are not the same as memberships or subscriptions, but they can be an alternative to those.

Here are some expert tips for using payment plans and increasing your courses’ revenue:

6 Expert Tips When Using Payment Plans

Tip#1: Ask for a higher initial installment

Ask for a first installment that’s 2 or 3 times higher than the next installments. This way, you’re asking someone to commit to your course.

Tip#2: Keep the number of payments low & under a year

The longer the payment plans, the more chances for someone to cancel or default on the payment. Keep the number of payments low and don’t let them spread for more than one year.

Tip#3: The dollar amount matters

You will make significantly more sales if you keep each payment in the double digits. Any price that crosses a double-digit border elicits a strong negative psychological response. For example, going from $99 to $100+ makes a huge difference from a mental standpoint. The number of payments, however, has quite the opposite effect, as we’ll see later.

Tip#4: Don’t set your price too low

Find the right balance and do not set installments (especially the first one) too low. The higher the value of your course, the higher the engagement and worth of your customers!

Tip#5: Coordinate drip content & expiration with the Payment Plan

It’s a good idea to offer a payment plan along a drip-feed course, so, if someone stops paying, they lose access.

Similar attention goes to course expiration. If course access expires for your users, keep them a little longer than the last payment, so you give them a chance to study your course.

Tip#6: Charge a little more than the one-off payment

It’s reasonable enough that the total charges from the payment plan be slightly larger than the one-off payment. Besides, you are not asking for all the amount up front. You should charge at least 5%-10% higher than the original price.

This is also an incentive for the customer to buy your one-off priced course!

Examples of payment plans

Now, if you have never set up payment plans before, here are some examples from which you can draw ideas for your own plans:

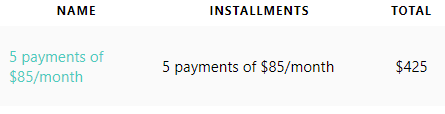

Scenario n.1 – Course price $400 to $425 with a Payment Plan

Often with a payment plan, you charge a little more since you aren’t getting all the money up front. For example, in the initial price above, you can raise each payment to $85 per month.

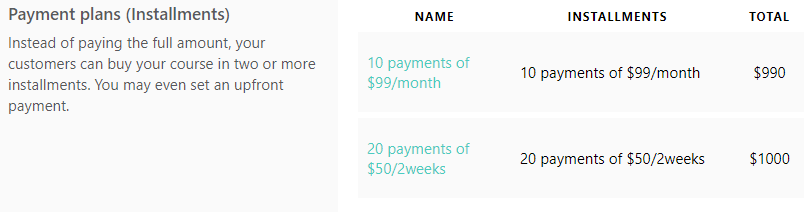

Scenario n.2 – Course price $900

What would draw the attention of more students, a 4-payments of $225 plan or a 10-payments of $99 plan? That’s right! The second plan. It has been proved that customers are more likely to opt for ten payments of $99 even though it results in paying 100 extra dollars over the other plan.

And vice versa: If you increase the payment from $99 to $125, the overall percentage of payment plan customers will go down even though the total overall cost will be lower! Strange but true.

So, the payment plans you can create for a $900 course could be these:

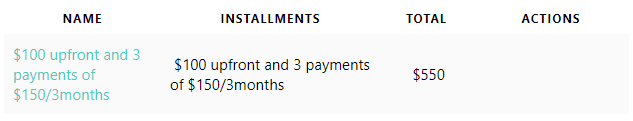

Scenario n.3 – Course price $550

Another way to facilitate student payments is to set longer intervals between the required installments. For example, instead of one-month intervals, you can ask students to pay every three or six months.

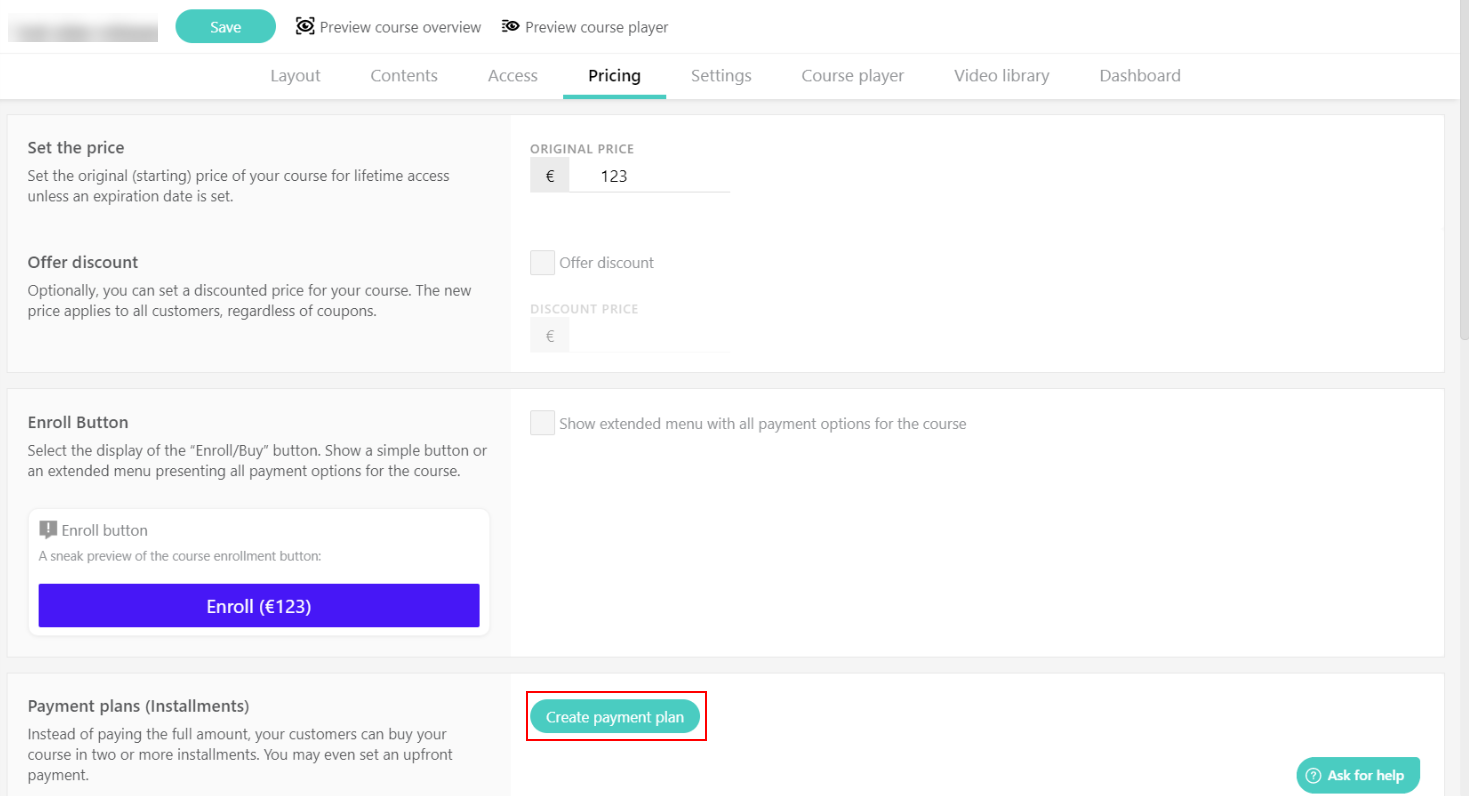

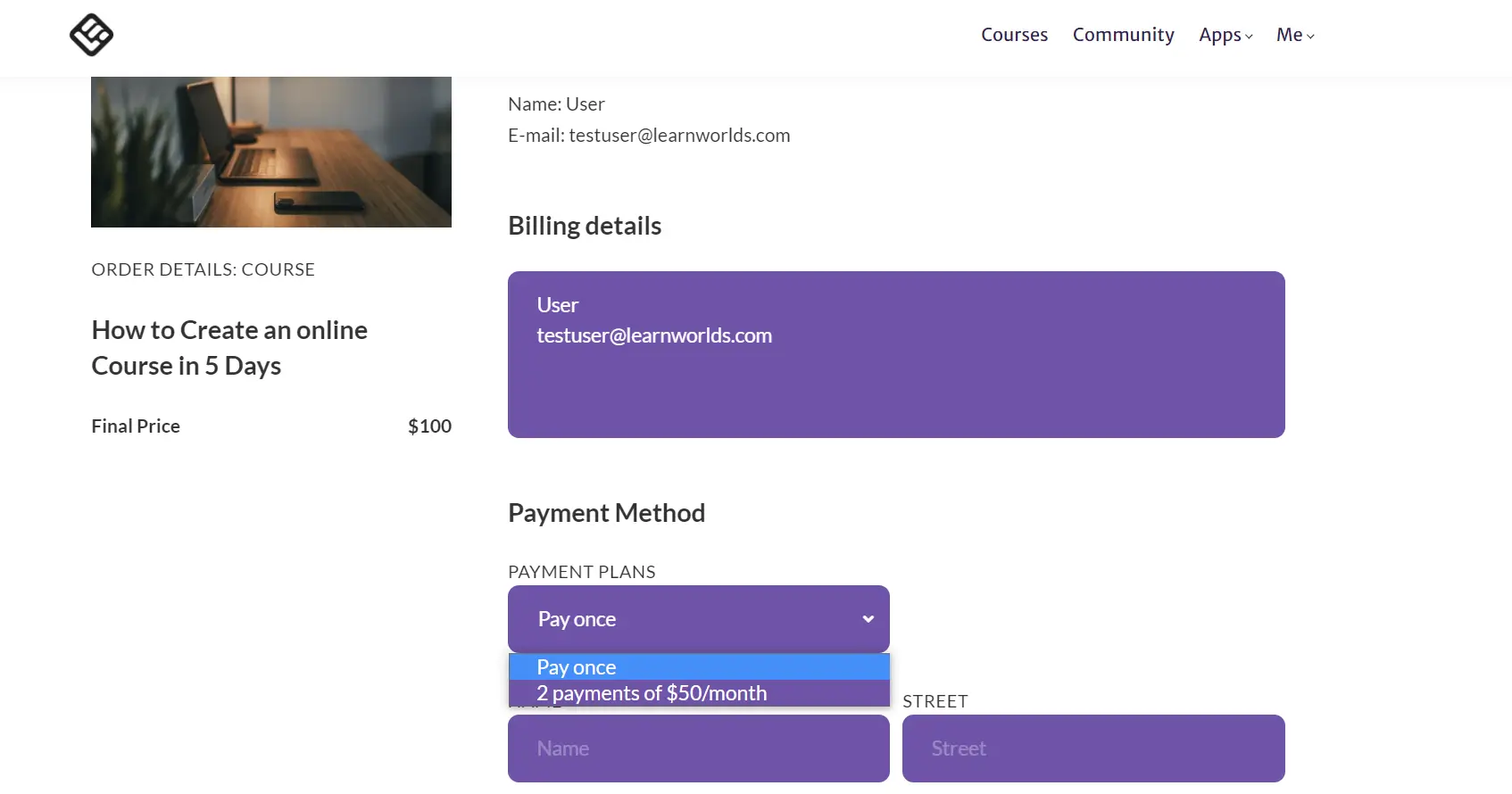

Payment Plans on LearnWorlds

LearnWorlds is the most robust and flexible course platform to create, host and sell online courses. As such, it offers an easy way to add payment plans on your online courses.

All you need is to connect Stripe as the payment gateway and set up your price.

LearnWorlds also comes with user friendly payment forms. Your payments will look professional and trust-worthy.

You can read more on payment plans and installments for LearnWorlds on our support articles.

Are You Ready to Sell Courses with Payment Plans?

By utilizing payment plans to sell online courses, you can increase the sales of your high-ticket courses, attract more customers and increase your prices.

It’s a great way to allow flexible payment options for your users and create a win-win scenario for you and them both.

What are you waiting for?

Try LearnWorlds with a 30-day trial today.

⚠️Payment plans require an active subscription of a Pro Trainer or higher plan and using Stripe as the payment gateway.

Frequently Asked Questions – FAQs

Should I offer a payment plan?

Payment plans are a great way to make a high-ticket purchase affordable. If you have a digital product priced at above $300, consider offering it with a payment plan.

Can I offer payment plans through LearnWorlds?

Yes, LearnWorlds allows you to offer payment plans and installments.

You will need to have a paid subscription of the Pro Trainer plan or higher and connect Stripe as the payment gateway to offer payment plans or installments as an option.

How do payment plans work?

Payment plans break a bigger payment into smaller, more manageable chunks. For example, if you have a product priced at $500, you can offer it for an initial payment of $200 and 3 monthly payments of $100.

Are payment plans different from memberships?

Yes. Memberships or subscriptions are intended for a community, coaching or course which offers a recurring benefit and can potentially be indefinite or for as long as your customer sees value to it.

On the other hand, payment plans are intended for highly priced products as a convenience to a buyer who would not be able to afford them otherwise.

Nick Malekos is a Senior Digital Marketer in LearnWorlds. He is a results based and well-rounded Digital Marketer with years of experience in the education industry, writer and digital literacy trainer.